The successful execution of well-informed decisions at the right time plays a vital role in the progress of cryptocurrency trading for financial gains and losses. The BTC heatmap ranks as the most attractive and enlightening analytical tool which traders currently possess. This powerful visualization tool presents traders with more confidence through eliminating complex market data thus helping them identify trends and formulate strategic decisions.

Heatmaps use color coding to show numerical values thus producing images which a human brain absorbs better than standard numerical data. The infrared color schemes used in Bitcoin trading visualizations show significant market trends together with psychological changes while exhibiting promising trade possibilities which were not apparent in typical spreadsheet formats or conventional charts.

A BTC Heatmap’s Structure

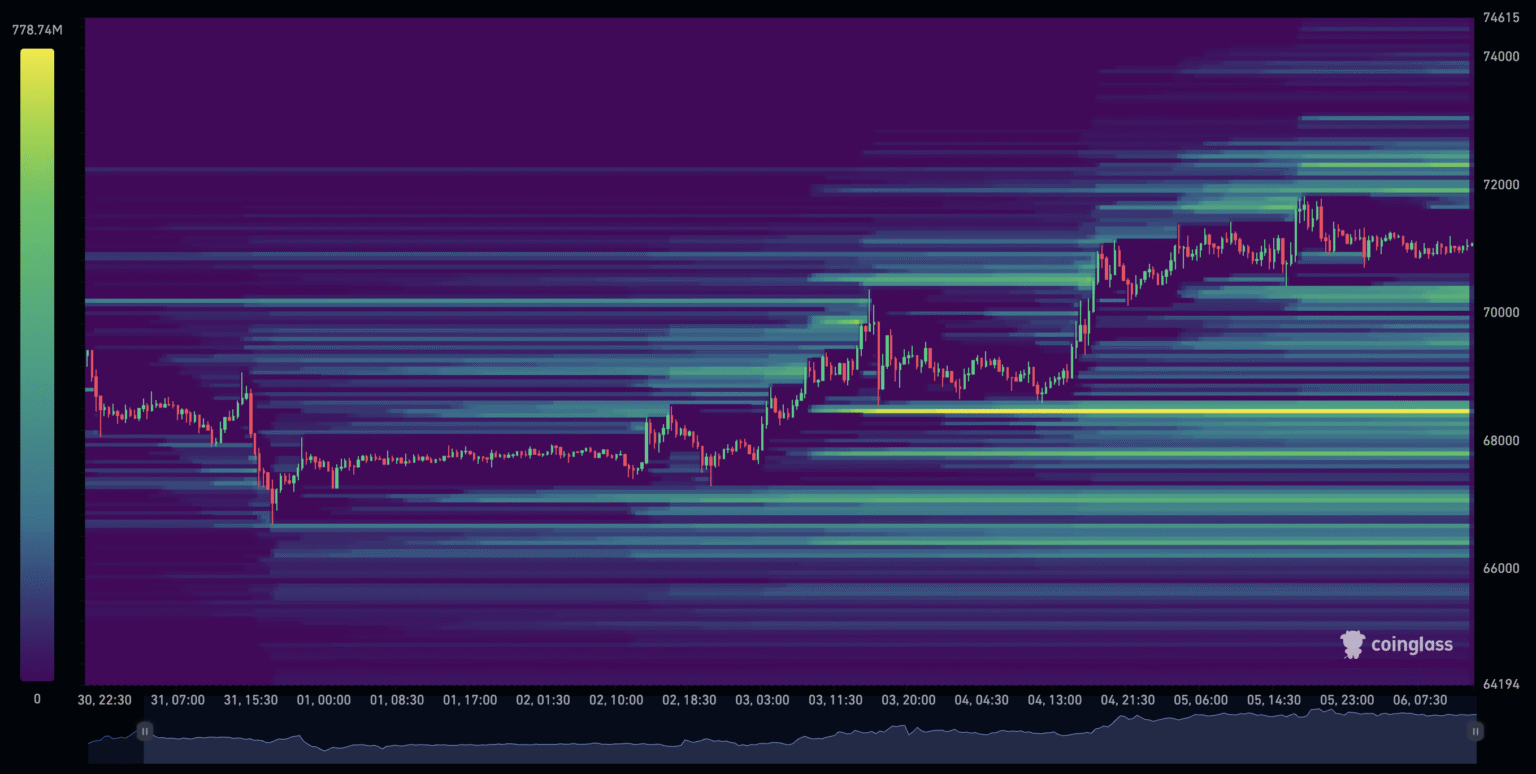

The definition of a BTC heatmap must be understood before delving into the strategic applications. This visualization of Major variables used in Bitcoin heatmaps display market capitalization together with buy/sell pressure alongside trading volumes and exchange or time-based price changes.

The market uses blue-green colors for reporting value decreases while red-orange tones signal value increases. The size of the change or value being measured frequently corresponds with the intensity of these colors. Additional visual components, including size changes or numerical overlays, may be used in certain sophisticated heatmaps to offer even more contextual information quickly.

The time periods that are shown might vary from weekly or monthly patterns for traders with longer investment horizons to minute-by-minute fluctuations for day traders. BTC heatmaps are useful for almost every trading strategy and period because of their versatility.

Recognizing Market Trends Quickly

Finding more general market patterns fast is one of the main benefits of employing a BTC heatmap. When looking at price movement heatmaps, similar-colored clusters frequently indicate potential directional trends. For example, a pattern that shifts from cooler to warmer hues over a number of time periods may point to increasing bullish momentum, whilst the reverse pattern may indicate the development of negative pressure in the market.

Volume-based heatmaps can reveal just as much. At some price levels, unusually large trading volumes may signal strong support or resistance zones, which is important information for figuring out possible entry or exit positions. When these volume clusters align with price reversals, they become even more important because they frequently indicate the possible start or finish of a trend.

Correlation heatmaps provide traders with important information about Bitcoin’s relationship with other cryptocurrencies. These graphics assist traders spot possibilities for diversification or possible market sympathy moves by illustrating how changes in the price of Bitcoin connect to those of other digital assets.

Recognizing Market Oddities and Possibilities

Beyond general patterns, BTC heatmaps are excellent at pointing out abnormalities, which frequently indicate trading opportunities. Abrupt variations in color intensity that are limited to particular exchanges, periods, or price levels usually signal anomalous market behavior that warrants further investigation.

For instance, a heatmap may indicate a possible arbitrage opportunity if it shows intense buying pressure (perhaps represented by a bright red area) on one exchange while other exchanges stay largely neutral. The same is true for isolated increases in trade volume at specific price points, which can indicate distribution or accumulation patterns that may presage major price changes.

Identification of possible price barriers or areas where the price may change quickly due to limited orders can be aided by liquidity heatmaps, which show the depth of buy and sell orders across price levels. Individuals who are aware of these “thin” spots in the order book beforehand, frequently present chances for rapid financial gain.

Interpreting Market Feelings

Market sentiment is a significant factor in changes in cryptocurrency prices, and BTC heatmaps provide special insights into the psychology of market players as a whole. Through the visualization of metrics such as funding rates, the ratio of long to short positions, or social media sentiment scores, these specialized heatmaps can assist traders in determining whether the market is primarily fearful or greedy.

In times of extreme market volatility or uncertainty, this sentiment analysis becomes especially useful. By displaying the locations of institutional traders’ bets, these visualizations can provide retail traders with important context for their own choices.

Improving Your Trading Approach

You need knowledge about reading BTC heatmap signals to integrate them with existing analytical information for successful implementation in trading strategies. Day traders can use heatmaps to find their trading entry and exit timing by showing trading volume and intraday volatility trends. The displayed timescales determine whether swing traders will see developing trends or potential reversal patterns.

Combining the visual insights of a Bitcoin heatmap with other analytical tools is the key to optimizing its value. Higher confidence in a possible bounce can result from the convergence of various signals, for instance, when a heatmap shows rising buying pressure at a price level that also matches a crucial technical support zone on a conventional chart.

Likewise, if volume heatmaps display accumulation patterns that match with favorable fundamental trends for Bitcoin, this convergence of technical and fundamental elements may indicate an especially auspicious opportunity. As one element of a comprehensive analytical approach that takes into account a variety of data sources and viewpoints, the most successful traders frequently employ heatmaps.

The Prospects for Bitcoin Heatmap Analysis

As cryptocurrency markets continue to develop and analytical tools evolve, BTC heatmaps are changing to include more data sources and more complex visualization methods. More and more, machine learning algorithms are being used to find hidden patterns in heatmap data that can go unnoticed by humans, which could result in even more accurate trade recommendations.

Modern platforms are now creating interactive representations that let traders delve into certain regions of interest or three-dimensional heatmaps that provide another layer of information. Others are attempting to include other data sources, including social sentiment analysis or on-chain analytics, into conventional heatmap frameworks in order to offer more thorough market insights.

Conclusion:

The BTC heatmap serves as an extremely effective visual analysis tool available to present-day cryptocurrency traders. Through these visualizations day traders can study massive amounts of data while identifying market patterns that would remain hidden otherwise because they transform complex market data into easy-to-understand colored visualizations.

Heatmaps can also greatly enhance your trading strategy by supporting you in recognizing promising opportunities and heading off ability hassle spots when applied cautiously and in combination with different analytical techniques. You may additionally trade extra intelligently and expectantly in a more and more complex market environment by integrating Bitcoin heatmap studies into your decision-making procedure, irrespective of whether or not you’re a day trader seeking short-term fee fluctuations or an extended-term investor tracking large marketplace styles.

Enjoyed this? Share this post with fellow fans and influencers, and be sure to check back regularly for the latest updates, insights, and news on all things simpcity!